🔍 Overview of Perfect EA

Perfect EA is a fully automated Expert Advisor (EA) designed for the MetaTrader 4 (MT4) platform. This EA is tailored for traders seeking a robust and adaptable trading system that can operate across various currency pairs and timeframes. Its core strategy revolves around grid trading, aiming to capitalize on market fluctuations by placing trades at predetermined intervals.

⚙️ Key Features

Platform Compatibility: Designed for MT4, ensuring widespread accessibility for traders.

Trading Strategy: Utilizes a grid trading approach, placing trades at set pip distances to exploit market volatility.

Currency Pair Flexibility: Capable of trading all currency pairs, providing versatility in market engagement.

Timeframe Adaptability: Suitable for multiple timeframes, allowing traders to align the EA with their preferred trading horizons.

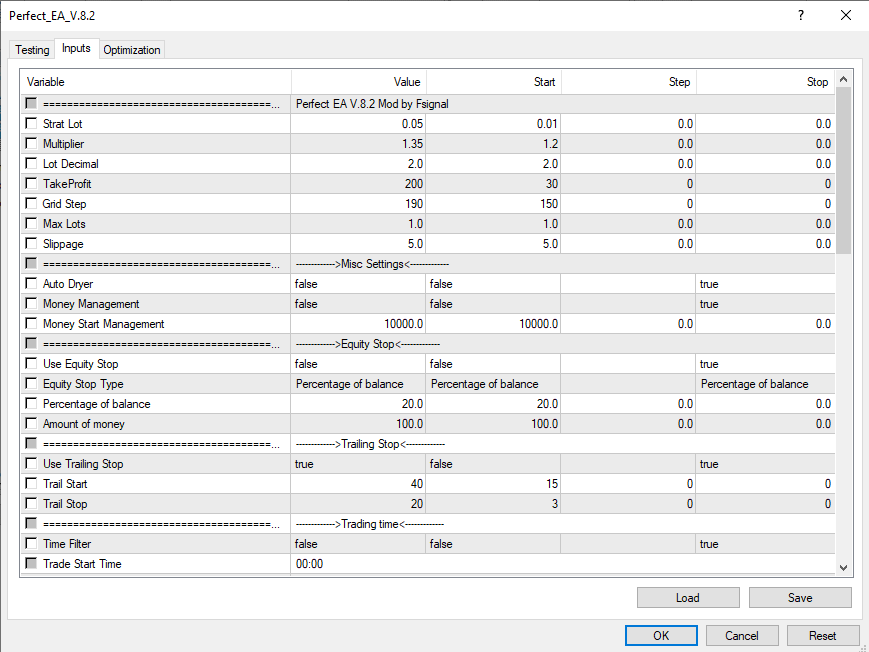

Risk Management: Incorporates features like Take Profit (TP), Stop Loss (SL), and Trailing Stop to manage trades effectively.

User-Friendly Interface: Offers an intuitive setup process, enabling traders to deploy the EA with ease.

🧠 Strategy and Usage

Perfect EA operates on a grid trading system, which involves placing buy and sell orders at regular intervals above and below a set price. This strategy is designed to profit from market volatility, capturing gains as the market oscillates. The EA automatically manages these trades, adjusting positions based on market movements and predefined parameters.

Usage Recommendations:

Market Conditions: Best suited for ranging markets where prices fluctuate within a certain range.

Account Balance: Recommended to start with a minimum balance of $500, as per user discussions on forums.

Lot Size: A starting lot size of 0.01 is suggested for optimal performance.

Timeframe: While adaptable, the M5-H1 timeframe has been commonly used by traders employing this EA.

⚠️ Important Considerations

Market Trends: Grid trading can be risky in strongly trending markets. It’s essential to monitor market conditions and adjust settings accordingly.

Backtesting: Prior to live deployment, conduct thorough backtesting to understand the EA’s performance under various market scenarios.

Demo Testing: Utilize a demo account to familiarize yourself with the EA’s operations and fine-tune settings without financial risk.

Risk Management: Always implement proper risk management techniques, including setting appropriate TP and SL levels, to protect your capital.